One of the most important parts of running a successful business is ensuring you have an acceptable amount of cash flow. The more money you have coming in, the more you will able to spend on things like marketing, advertising, and production to push your company forward. One of the best ways to help success when it comes to cash flow is to improve your invoicing and make it more efficient. Without further ado, let’s take a dive into learning how to make an invoice and looking at a free invoice template.

How to Make an Invoice: Tips for More Effective Invoicing

This blog post is going to take a look at a few different tips to helping the invoicing of your business be effective and efficient.

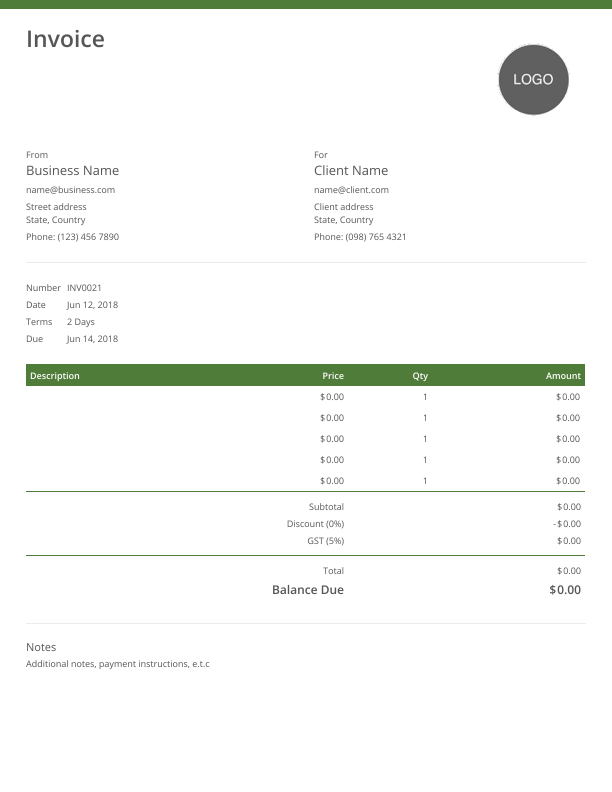

1) Use the Right Invoice Template

While you might think a standard word or excel document is suitable for your invoices, this might not be the case. Using an overly plain and basic invoice can potentially make you and your company seem amateur. So you might want to consider using something a little more elegant.

In addition to helping you be taken more seriously, using an appropriate template will help avoid any confusion in your clients.

Your invoice should easily show how much they have to pay, what it’s for, where to send the money and more. If your invoice is confusing or unclear, it could potentially lead to some late payments or frustration from your clients. When it comes to designing the best invoice template, you can create your own or can also consider using this free invoice template.

2) Include a Due-Date

Most small businesses wait nearly a month to get paid for their work. It is incredibly important to include a due date on your invoice. If not, you are basically inviting your client to pay you whenever they have the time or money. This could be a week, or this could be two months. A deadline allows the client to see when you expect to be paid by and hopefully they will act accordingly.

You should discuss with the client ahead of time and try to come out with a suitable amount of time for the due date. Also, your due date time frame should remain fairly consistent over time to keep things easy for everyone. You don’t want to constantly be switching from a 14-day period to a 30-day period. This can prove quite confusing to the receiver.

3) Give Bonuses for Early Payment (and Penalties for Late Payment)

It is not a secret that people respond well to incentives. If there is some benefit or “free extra” that someone can get by doing something else, they are likely to do it. This is commonly seen in those “Buy 2 get 1 free” deals, but also makes sense in the context of invoicing. If you offer a coupon or slight discount for early payments, there is a good chance that clients will pay you quicker to take advantage of them.

On the other hand, you could also add-in a late fee for those who don’t make payments on time. If there are no late fee or no early bonus, many companies may not prioritize paying you. This, in turn could lead to frequent late payments.

4) Track Everything

It can be difficult to keep track of numerous clients. This makes it quite simple to forget or miss an invoice. Missing an invoice, quite obviously causes you to miss out on a lot of money. As a result, it is very important that you track your invoices and everything related to them. These factors include when it was sent when it’s due and how much it was for.

Not only will this ensure no one misses a payment, but it can also provide you important data. This includes how long certain clients have to pay you back, how long you have been working with certain clients, and more. Tracking and numbering invoices will also help with your accounting and make tax time a lot less stressful.

5) In Conclusion: Automate your Invoicing

If you send large quantities of invoices to the same clients on a relatively predictable basis, you should consider automating your invoices. If you don’t have to waste time every month sending invoices or trying to remember to send them, it can save you a lot of time.

There are a variety of services and companies that can help you send out invoices automatically. In addition to sending invoices automatically, you can also send reminders automatically once a certain time has passed. These methods will save you from having to chase down payments. One of these services includes Simple Invoices which is a free and open-source software. Simple Invoices can easily be hosted on SkySilk. Simple Invoices is also full of a variety of free invoice templates to use.

We sincerely hope that the tips within this article are able to help you improve the invoicing of your business. While invoicing is an afterthought for many companies, it can determine how quick you get paid for the work you have done.

Use promo code “SKY95INVOICE” to save 95% off your first month. Offer is valid for new users only.